New Delhi:

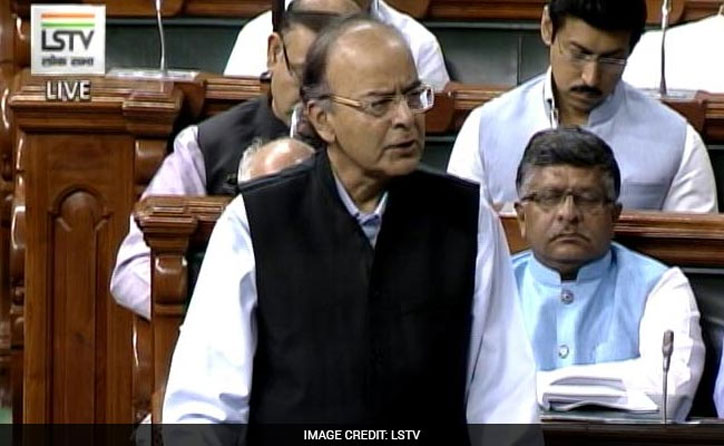

New Delhi: Finance Minister Arun Jaitley has moved four GST (Goods and Services Tax) bills in Lok Sabha today.

Calling it a revolutionary step which would benefit all, Jaitley said both states and the Centre had pooled in their sovereignty into the GST council.

Speaking in the Lok Sabha, he said 12 meetings of the GST council were held to make it a process based on consensus and recommendations.

The July 1 deadline for the launch of the Goods and Services Tax or GST "looks real," union Finance Minister Arun Jaitley said on Wednesday morning just ahead of a debate in the Lok Sabha or lower house of Parliament on four supporting bills crucial to the roll-out a unified tax regime.

Seven hours have been allotted for today's debate, initiated by Mr Jaitley, who detailed the provisions of the bills and the benefits of GST.

For the Congress, former union minister M Veerappa Moily is the first speaker.

Here are 10 latest developments on the GST bills debate:

The Government requested the Speaker to skip Zero Hour today to start the debate early. After the debate, the 250-odd clauses in the bills will be voted on one by one and the process will take a long time..

Arun Jaitley said the government is confident of a consensus on the bills in the house today.

He also said the government was on track with GST and he is "reasonably hopeful" of a July 1 launch.

"I am reasonably hopeful. So far, we are maintaining the timelines. Unless something unforeseen happens, the July 1 target looks real," Mr Jaitley told NDTV.

The government has emphasised that it wants the GST bills to be passed in Parliament with the consensus of all parties as was witnessed in August last year when a bill to amend the Constitution was passed to facilitate the launch of GST.

The Congress says the bills in their current form are "not acceptable" and its speakers today will raise their concerns and demand changes. The party's main demand reportedly still remains a flat GST rate rather than a four-slab structure.

But senior Congress leaders are also wary of being seen as stalling the biggest tax reform since Independence and have suggested treading cautiously. Congress vice president Rahul Gandhi told his party's lawmakers at a meeting on Tuesday that they should play the role of a constructive opposition.

The government, which has a big majority in the Lok Sabha, expects to get the lower house's approval for the GST bills with ease in the vote at the end of today's debate. Any amendments sought by the Congress or other opposition parties will also be voted on.

The bills will then go to the Rajya Sabha or upper house for discussion. Because they are all "money bills", the Rajya Sabha can suggest changes which will be taken back to the Lok Sabha. The Lok Sabha can choose to accept or reject the proposals.

The government has to ensure that this entire process is wrapped up by April 12, when the Budget session on Parliament ends, to be able to to meet the July 1 launch date. It has already missed an earlier deadline of April 1 for GST roll-out.

The bills being debated today are the Central GST bill, the Integrated GST bill, the Union Territories GST bill and the compensation law. Once these get Parliament's nod, a state GST bill will be presented in state assemblies for their approval.

GST subsumes a slew of indirect taxes at the centre and in states. The one-nation one-tax regime is expected to boost the rate of economic growth by about 0.5 percentage points, broaden the revenue base and cut compliance cost for firms.

India's most ambitious indirect-tax reform is likely to roll out from July 1.

How well do you know your GST? Here's a brief explanation of its various aspects:What is GST?The Goods and Services Tax (GST) will replace nearly a dozen central and state levies into a single national sales tax. It will make the movement of goods cheaper and seamless across the country. It would be far simpler than the current system, where a good is taxed multiple times and at different rates.

What will be the rates?There would be four tax slabs of 5, 12, 18 and 28 per cent, plus a levy on taxes on luxury items like cars, aerated drinks and tobacco products to compensate states for any revenue losses in the first five years. The GST council is yet to decide which goods fall in which slab. The GST rates will remain broadly in line with the existing rates. To keep inflation under check, essential items including food, which presently constitute roughly half of the consumer inflation basket, will be taxed at zero rate.

How will consumer benefit from the GST?With the implementation of GST, consumers will not be subjected to double taxation. All taxes that are levied while purchasing good will include both the central government’s taxes as well as the state government’s taxes. The move would deter state governments from indiscriminately increasing taxes fearing public backlash.

What economic impact will it have?GST can boost economic growth by as much as 2 percentage points, according to Finance Minister Arun Jaitley. Greater tax compliance has the potential to boost revenues for the government, helping narrow Asia's widest budget deficit and allowing more funds to be allocated to schools and highways.

How will the GST affect businesses?Companies will have to overhaul their accounting systems, which may involve one-time investment costs. There may also be chaos in the short term as the government gets the computer software up and running. The government has trained 49,000 officers of the states and the Centre till last week. GST Network (GSTN)—GST's IT infrastructure arm—and CBEC together will now conduct trainings so that businesses know how to file their returns

Which sectors stand to gain the most?Logistics companies stand to gain as it becomes easier to ferry goods across India. Other sectors largely depend on the fine print of the GST, including exemptions.

New Delhi: Finance Minister Arun Jaitley has moved four GST (Goods and Services Tax) bills in Lok Sabha today.

New Delhi: Finance Minister Arun Jaitley has moved four GST (Goods and Services Tax) bills in Lok Sabha today.